One of the biggest challenges insurance agents face today is managing multiple tasks effectively. From lead generation and customer acquisition to policy management and claims processing, there’s no shortage of responsibilities that require attention. The sheer volume of work can be overwhelming for even the most experienced insurance professionals. An insurance virtual assistant is the best solution to help agents manage their workload more efficiently.

They can handle routine tasks like data entry, scheduling appointments, and answering basic questions from clients. This allows agents to focus on more pressing matters, such as providing personalized service to their clients or developing new business strategies. This article explores how an insurance virtual assistant can take the load off your shoulders and help you focus on what matters most – growing your business.

What Is an Insurance Virtual Assistant?

A virtual insurance assistant is a remote professional who supports insurance agents and brokers. They are typically hired for marketing, prospecting, and administrative duties. These professionals work remotely and use technology to communicate with their clients.

Insurance virtual assistants are skilled in various areas, such as social media management, email marketing, lead generation, appointment scheduling, data entry, etc. They can also provide other services like bookkeeping or customer service, depending on the needs of the insurance agency.

Virtual assistant insurance can help agents save time by handling routine tasks like scheduling appointments or following up with leads. This allows agents to concentrate on tasks like building client relationships or closing deals. They can be a valuable addition to any agency looking to streamline their operations and increase productivity while reducing the costs of hiring full-time staff.

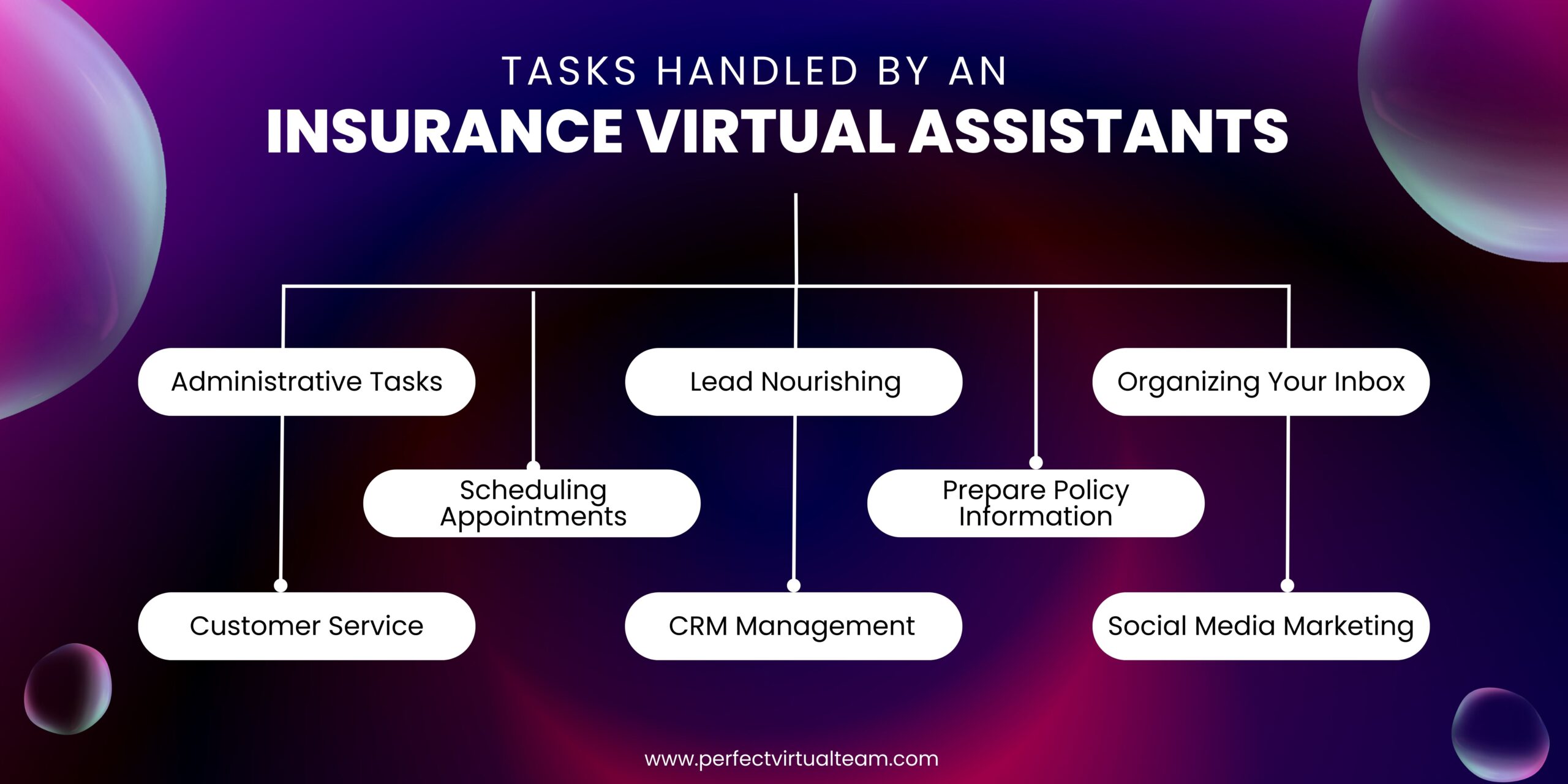

Tasks that can handle by Insurance Virtual Assistants:

Administrative tasks

Administrative tasks are a critical part of the day-to-day operations of any insurance agency. These tasks range from basic data entry and transcription to more complex areas such as file management, email management, and research. With the increasing demand for efficiency and accuracy in these areas, many insurance agencies are turning to virtual assistants to help manage their administrative workload.

An insurance virtual assistant can take over various tasks, such as scheduling appointments, managing emails and customer service inquiries, and completing paperwork. By taking care of these activities, your team can focus on other critical business aspects, such as client outreach and generating sales leads.

Customer service

Customers expect quick and efficient service from their insurance providers. With the help of insurance virtual assistants, companies can offer personalized and streamlined communication to their clients. They provide accurate information and respond quickly to customer queries, allowing agents to focus on more complex issues that require human interaction. VIAs can help reduce operational costs for insurers while improving customer satisfaction levels.

Scheduling appointments

Scheduling appointments can be time-consuming and distract agents from their core responsibilities. An insurance virtual assistant can help agents schedule appointments by contacting potential clients and finding a suitable time for them to meet with an agent.

Virtual assistants are skilled at managing calendars and ensuring all parties are available at the agreed-upon time. They can also send reminders to the client and agent before the appointment to reduce no-shows or cancellations. Virtual assistants can reschedule appointments quickly and efficiently if any changes need to be made.

Having virtual assistant insurance to schedule appointments allows insurance agents more time to focus on building relationships with clients and providing quality service. With their expertise in scheduling and organization, virtual assistants can provide valuable support that helps insurance agencies run smoothly and efficiently.

Preparing policy information

One of insurance agencies’ most critical tasks is preparing policy information for their clients. This involves a lot of administrative work, which can be time-consuming and tedious. However, with the help of virtual assistant outsourcing, this task can be streamlined. The insurance virtual assistant prepares proposals and ensures that policy information is up-to-date for each client.

Virtual assistants can take care of all aspects of proposal preparation, including researching the client’s needs and preferences, analyzing data, creating proposals from scratch, or modifying existing ones to suit specific requirements. They can also ensure that policy information is updated regularly by reviewing documents and updating policies in real-time as changes occur.

Lead generation and nourishing

Virtual assistants can significantly reduce insurance agents’ workload regarding lead generation, nourishing, and management. They can help create targeted marketing campaigns that attract potential leads and collect their contact details for future follow-up.

Virtual assistants can handle email marketing, social media management, and content creation that help keep tips engaged with the brand. They can also assist in managing existing leads by updating databases regularly and scheduling appointments for agents to meet prospective clients face-to-face or over the phone.

Taking payments

One task a virtual assistant can handle for an insurance agency is taking client payments. With the rise of online payment options, many insurance companies now offer their customers the ability to pay premiums through their website or mobile app. This can be time-consuming and repetitive for agency staff to handle daily. Insurance virtual assistants can securely process payments, send out invoices and receipts, and even set up recurring payment schedules for clients who prefer automatic deductions.

Organizing inbox

Insurance agents receive hundreds of emails from clients, prospects, and other stakeholders daily. Having a VA read, filter, and classify these emails according to type and priority allows agents to save hours each week and ensure they are giving attention to the most pressing matters.

In practice, this might involve creating different folders or labels for different types of emails (such as claims inquiries or policy updates), setting up filters to route particular messages to specific folders automatically, and flagging urgent messages for immediate attention. VAs can also respond to routine inquiries or forward messages to the appropriate team member for follow-up. These tasks help agents stay organized, reduce stress, and provide better customer service.

CRM management and creating reports

CRM reports provide valuable insights into customer behavior, sales trends, and marketing effectiveness, among other things. Insurance virtual assistants analyze these insights to make data-driven sales strategies, product offerings, and customer service decisions.

CRM management also enables insurance agencies to streamline their operations by centralizing all customer information in one place. Virtual assistants manage CRMs and generate reports for insurance agencies.

Handle social media marketing

Maintaining a positive brand image can be highly important nowadays to get in touch with viewers and potential clients. Insurance virtual assistants help you to create engaging content for your social media platform, following the latest trends and opportunities in the market.

Insurance VAs are proficient at promoting insurance services and can boost your reputation tremendously by running various campaigns. They also help you to maintain your brand’s reputation and quick response to the viewer’s queries and comments.

The Benefits of Hiring Virtual Assistant Insurance

Delegate specific tasks to them

When it comes to delegating specific tasks, insurance agents can opt for general as well as more technical functions. Available functions may include data entry, appointment scheduling, phone calls, and email management, while more technical tasks may involve research and analysis of customer data or claims processing.

Hiring a capable professional ensures your work is completed accurately and on time. Delegating these functions frees up your calendar so you can concentrate on generating leads or meeting with clients. An insurance virtual assistant allows agents to streamline their workflow and improve productivity without sacrificing quality or accuracy.

Reduced operating cost

Virtual insurance assistants charge per task or hour worked, which can result in substantial cost savings for businesses. With a virtual assistant, you don’t have to worry about providing healthcare, paid time off, or retirement plans.

By outsourcing tasks to virtual assistants, businesses can avoid overhead expenses related to keeping a physical office, such as rent and utility bills. Hiring virtual assistants is an excellent way for companies to reduce operating costs while still getting quality work done. By leveraging technology and remote work arrangements, businesses can focus on development without worrying about added expenses of traditional employment models.

Increased operational efficiency

Tasks, including email management, data entry, scheduling appointments, and customer service inquiries, are some of the responsibilities that virtual assistants can handle. Outsourcing these tasks to virtual assistants allows business owners to free up their time and energy should pay attention to other crucial aspects of running their businesses.

This will enable them to improve their productivity levels and increase revenue streams without hiring additional staff or investing in expensive technology. Hiring a virtual assistant could be a wise investment decision for businesses looking to streamline their operations while reducing overhead expenses.

Improved customer service

virtual insurance assistants can provide customer support and assistance so that customers can get their questions answered and issues resolved quickly and efficiently. This not only helps to improve customer satisfaction but also helps to reduce the workload on insurance agents.

Virtual insurance assistants handle routine tasks such as answering frequently asked questions, processing claims, and providing policy information. This frees up the time of insurance agents, who can then focus on more complex issues that require their expertise. They analyze data to identify areas where improvements could be made in service delivery. Insurers can use this information to allocate resources and improve their customer experience strategically.

Conclusion

An insurance virtual assistant can be a game-changer for insurance agents and companies. It takes the burden off their shoulders by handling mundane tasks, improving efficiency, and providing better customer service. Whether you’re looking to save time, increase productivity or boost revenue, partnering with an insurance virtual assistant can help you achieve your insurance business goals and stay ahead of the competition. So, schedule a free consultation with the Perfect virtual team today to hire a highly experienced and trained insurance virtual assistant. We help you to build a high-performance team that delivers results.

Our insurance virtual assistant handles all the tedious work of an insurance business, allowing you more time to focus on other essential tasks. They can help with data entry and management, document preparation and processing, appointment scheduling, and reminders. They assist you during your time zone. This ensures that customers always have access to answers whenever they need them, without waiting long for response times.