Financial advisors often find themselves bogged down with back-office responsibilities, such as paperwork and administrative tasks. These tasks can take up a significant amount of time that could be better spent on generating income for the business. However, neglecting these tasks can lead to costly mistakes and missed opportunities. So hiring a virtual financial assistant is the best solution. A virtual assistant for a financial advisor can handle many of the necessary back-office tasks, freeing up the advisor’s time to focus on more critical aspects of their job.

Financial advisors can streamline workflow and increase productivity by delegating administrative duties to a virtual assistant. A virtual financial assistant can provide additional support in managing finances for clients. With access to advanced software and technology, VAs can assist with budgeting, tracking expenses, and creating financial reports. This added value benefits the advisor and helps build trust with clients who appreciate efficient and effective financial management services.

What Is A Virtual Financial Assistant?

A Virtual Financial Assistant or VFA is a remote worker who provides financial administrative support services to businesses and individuals. They can handle various tasks such as bookkeeping, invoicing, payroll management, tax preparation, and financial reporting. A virtual assistant can take care of these tasks while you focus on other essential aspects of your business.

Virtual Financial Assistants typically work from their offices using their equipment and software, so you don’t have to worry about the overhead costs of hiring an in-house employee. They are remote workers, and you don’t need to worry about geographical limitations when seeking the best talent for your financial needs.

Tasks of a Virtual Assistant for Financial Advisors:

Administrative tasks

Virtual financial assistants have experience handling administrative tasks that will allow them to focus on other critical areas of your business. They manage recurring & administrative tasks like scheduling meetings with current and potential clients. It involves coordinating schedules, sending invitations, and following up on confirmations.

Virtual financial assistants can help you maintain an organized database that contains all the relevant information about your clients and customers. They also assist with data entry tasks like entering new customer information or updating existing records whenever required so that you can access vital data when needed quickly.

Track your expenses

Tracking expenses is essential in managing your finances. It lets you see where your money is going and helps you make informed decisions about allocating your funds. By tracking your expenses regularly, you better understand your spending habits and identify areas where you may be overspending.

A virtual financial assistant can monitor all your expenses daily. Regularly reviewing and analyzing your spending also helps you identify potential areas for cutbacks or savings opportunities. This information helps you to create a budget aligning with your financial goals and priorities.

Customer support services

A virtual financial assistant assists customers who call in with queries regarding their accounts, transactions, and other financial matters. Another critical aspect of customer support services is chat support. This involves instant messaging assistance to customers who reach out for help via online chat platforms.

Answering emails from clients is also a vital customer support service that falls within the remit of a virtual financial assistant. Consolidating recurring customer concerns is another area where a virtual financial assistant can add value by identifying patterns or trends in frequently asked questions from clients. Keeping track of these patterns helps managers make informed decisions on improving their product or service offerings, ultimately enhancing overall customer satisfaction.

Business support

Virtual financial assistant researches competitors, analyze consumer behavior, or identify potential investment opportunities. The information gathered from this research can then use to make informed business decisions and strategies. VA help in report generation or other business documents that provide insights into key metrics and performance indicators.

In addition to market research and report generation, a financial virtual assistant also be responsible for navigating customer relationship management (CRM). This involves managing customer data, tracking client interactions, and using data analytics to identify trends or patterns in customer behavior. A skilled virtual assistant for financial advisors can help streamline business operations and drive success in a competitive marketplace by providing support in these areas.

Marketing support tasks

A financial virtual assistant creates, updates, and manages social media profiles for your client’s business. Virtual assistant for financial advisors researches the target audience and creates content that will appeal to them. They monitor the performance of social media campaigns, measure engagement rates, and track metrics like click-through rates. Financial VAs are responsible for writing blog posts or articles about relevant topics.

Lead management

Lead generation involves finding potential customers through various channels, including social media, email marketing campaigns, and website traffic. Virtual assistants for financial advisors identify the right target audience and create an engaging message that resonates with them. Screening of leads involves assessing the quality of leads generated from various sources. Financial VAs must qualify leads based on budget, authority, need, and timing. This step helps prioritize leads and focus on those likely to convert into paying customers.

Cold calling is essential for reaching out to new prospects without interest in your brand. Financial virtual assistants should have excellent communication skills when making cold calls since it requires convincing people not initially interested in your offering. Good lead management skills can help financial virtual assistants build successful customer relationships that drive business growth over time.

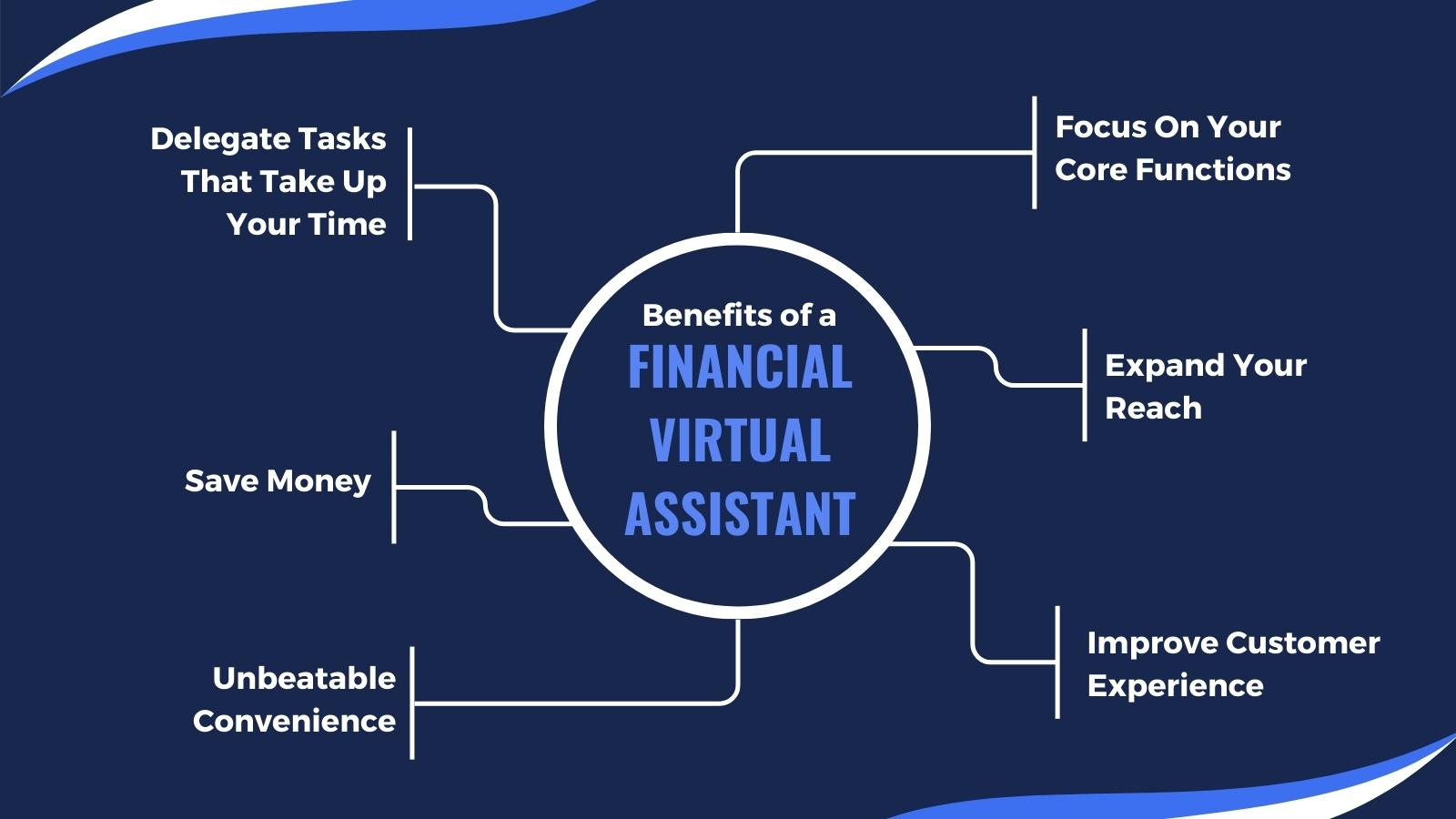

How can a financial advisor benefit from hiring a Financial Virtual Assistant?

Delegate tasks that take up your time

Financial advisors face numerous challenges. On top of managing portfolios, staying up-to-date on industry trends, and meeting with clients regularly, they also need to handle administrative tasks such as scheduling appointments, responding to emails, and managing paperwork. These tasks can consume significant time and energy that could be better spent helping clients achieve their financial goals.

By delegating these time-consuming tasks to a financial virtual assistant, Advisors can clear their schedules and concentrate on what they do best: providing personalized financial guidance to clients. With the help of virtual assistant services, financial advisors will have more hours to dedicate to researching new investment opportunities or building relationships with existing clients. Virtual assistants can work with you during weekends and holidays. This gives advisors peace of mind knowing they have additional support available when needed without paying year-round salaries for full-time support staff, even during slow periods.

Save money

The most significant advantage of employing a financial virtual assistant is that it can help you save money by handling critical activities that do not require your skills. This way, you can focus on higher-value activities that generate more revenue for your business. For example, a virtual assistant for financial advisors can do administrative responsibilities like scheduling appointments, answering emails and phone calls, managing social media accounts, and updating spreadsheets.

Hiring a virtual assistant can also help businesses save money in several other ways. By outsourcing these non-core functions to virtual assistants, companies can reduce overhead costs associated with office space rental, equipment purchase or maintenance, and employee benefits such as health insurance or retirement plans.

Focus on your core functions

A financial advisor’s core function is to guide clients on their investments, wealth management, and financial planning. However, administrative tasks such as paperwork, scheduling appointments, and answering emails can take significant time. By hiring a financial virtual assistant (VA), advisors can delegate these non-core functions and focus on building client relationships.

With a VA taking care of non-core functions essential for running a successful business, such as scheduling meetings with clients or potential investors, while you handle core functions like investment analysis or relationship building; this ultimately increases productivity and profitability for your firm all while giving you more free hours outside of work!

Expand your reach

A virtual assistant for financial advisors can help create clear to-do lists that outline the critical tasks and deadlines for the advisor. This ensures that nothing is missed or forgotten and all tasks are completed on time.

A virtual assistant can explore new leads for the financial advisor. They can research potential clients and identify new opportunities for business development. Doing so, they help expand the advisor’s reach beyond their existing network. Hiring a financial virtual assistant is an effective way for advisors to expand their reach and grow their business while maintaining high service delivery standards.

Improve customer experience

With a virtual assistant for financial advisors, they can ensure quick responses to their client’s queries, providing them with the timely and accurate information they need. This not only boosts client satisfaction but also helps build trust and loyalty.

Virtual assistants can also help advisors maintain continuous feedback and communication through mail and messaging. By keeping clients updated on their investment portfolios or other important updates, advisors can strengthen their relationships with clients while reducing the likelihood of misunderstandings or missed opportunities.

Unbeatable convenience

This is because virtual assistants are location-independent, meaning they may work from anywhere as they can access the internet. Therefore, financial advisors can hire assistants from around the globe and still receive quality services. Online communication support makes it easy for financial advisors to communicate with their virtual assistants anytime. Email, video conferencing, and instant messaging ensure seamless and efficient communication. Financial advisors can easily delegate tasks to their assistants and receive updates on progress promptly.

Financial advisors do not have to worry about different working hours or holidays since their assistants work flexibly. Overall, hiring a financial virtual assistant provides unbeatable convenience that saves time and increases productivity for financial advisors.

Conclusion

Virtual financial assistants can assist financial advisors with various duties, including bookkeeping, customer services, administrative tasks, and more. By outsourcing these tasks to virtual assistants, financial advisors can focus on building their businesses and providing quality service to their clients. So, schedule a free consultation with Perfect Virtual Team today to hire highly experienced and skilled virtual assistants for financial advisors. Our team of professionals handles all the time-consuming administrative tasks.

Our virtual financial assistant team can handle many tasks, including bookkeeping, appointment scheduling, email management, and more. They can assist you during your time zone, allowing you to maximize your productivity and free up valuable time. With our virtual assistant services for financial advisors, you can rest assured that your day-to-day operations will run smoothly and efficiently.