Business owners have a lot to keep track of and manage daily. From managing cash flow, protecting assets, and keeping up with the more tedious aspects of accounting, it cannot be easy to stay on top of everything. Having an Accounting Virtual Assistant can be a lifesaver for businesses needing to stay organized and current with their finances. An Accounting Virtual Assistant provides the necessary support to maintain a healthy cash flow, protect assets, and handle the more tedious tasks related to bookkeeping.

What is an Accounting Virtual Assistant?

Accounting virtual assistants are becoming increasingly popular among businesses as they can remotely handle administrative tasks and maintain financial records. They provide a cost-effective way to manage a business’s financial aspects without hiring an in-house accountant or accounting firm. Accounting virtual assistants can assist with bookkeeping, accounts receivable and payable, budgeting, general ledger maintenance, and other related financial services.

These professionals have expertise in generally accepted accounting principles (GAAP) and understand the importance of accurate financial record-keeping for businesses. They know how to use software programs like QuickBooks for small and large businesses. The virtual assistant will also ensure that all accounting documents are up-to-date and compliant with local tax laws.

Who Should Hire a Virtual Accounting Assistant?

Virtual accounting assistants are ideal for small business owners and accounting organizations who don’t have the time or resources to hire an in-house accountant. They offer financial expertise remotely, helping business owners stay on top of their finances without worrying about accounting or other administrative tasks that come with hiring an employee. Virtual accounting assistants can help ensure accuracy and organization regarding taxes, bookkeeping, accounts payable/receivable, and more – all at a fraction of the cost! By integrating an Accounting Virtual Assistant into their business operations, small business owners, freelancers/solopreneurs, and medium-sized companies can streamline their financial processes while saving time and money that would otherwise be spent on hiring an in-house accountant or outsourcing these tasks to expensive firms.

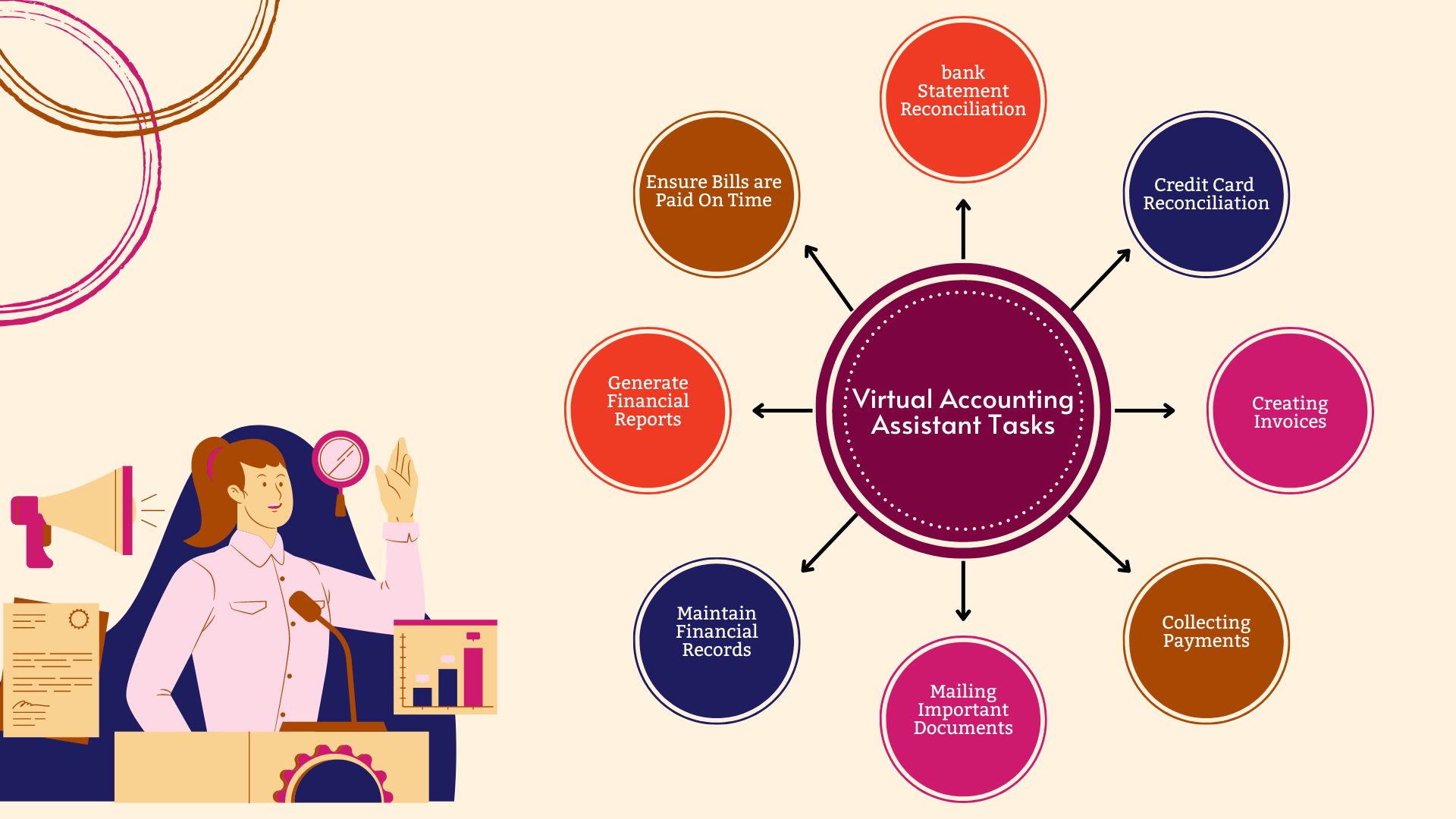

Tasks a virtual Accounting Assistant Can do for you

Maintain financial records

One of the critical roles of an accounting virtual assistant is to help businesses manage financial records accurately and efficiently. These professionals are well-versed in various accounting software and tools, allowing them to keep track of income, expenses, and other financial transactions. They can input data into the system, reconcile bank statements, and generate reports that provide valuable insights into a company’s financial performance.

In addition to regular bookkeeping tasks, accounting virtual assistants can help identify areas where businesses can save money or increase revenue. By analyzing financial data trends over time, they can pinpoint inefficiencies or opportunities for growth that may go unnoticed by business owners. Their financial analysis and reporting expertise make these professionals invaluable assets in helping companies achieve their long-term goals while maintaining vital financial health.

Ensure bills are paid on time

A virtual accounting assistant can help you ensure all your bills are paid on time and accurately, no matter how many times they need to be sent out. With a virtual accounting assistant, you can access various helpful tools, such as automated bill reminders and payment schedules. It also allows for better budgeting and financial security. Additionally, some virtual accounting systems offer additional features like expense tracking.

Credit card and bank statement reconciliation

A virtual accounting assistant can help your business reconcile credit cards and bank statements quickly and efficiently from any device with an internet connection. This allows you to focus on other aspects of your business that require more attention, such as sales or marketing efforts. With a virtual accounting assistant, you’ll be able to easily track all your financial transactions in one place, helping to reduce errors due to manual entry mistakes.

Creating invoices & collecting payments

A virtual accounting assistant can save time and energy by creating invoices and collecting payments. With a virtual assistant, it’s easy to track the progress of an invoice from generation to payment. Your virtual accounting assistant will generate customized invoices for each client that reflect your company’s branding and send reminders when payments are due or overdue. A virtual accounting assistant can take the hassle out of billing by streamlining processes such as tracking payments, sending invoices, recording transactions, and updating account balances in real time.

Mailing important documents and invoices to customers

Mailing important documents and invoices to customers is essential to a successful business. With the emergence of virtual accounting assistants, businesses can now delegate this task to a reliable and cost-effective source. Virtual accounting assistants can handle all mailing tasks efficiently and accurately, from sending promotional material, billing statements, and customer invoices to postal mailings, such as filing annual tax returns or returning documents.

Generate financial reports

One of the critical accounting virtual assistant tasks that a can do is generate financial reports. This includes income, balance sheets, and cash flow statements, providing businesses detailed insight into their financial performance.

Why hire a Virtual Accounting Assistant?

Cost savings

With the ever-changing business landscape, hiring a virtual accounting assistant is a cost-effective option for businesses of all sizes. The benefits of having an extra hand on your accounting staff can provide cost savings and minimize labor costs for any organization. By utilizing a virtual accounting assistant, you’ll be able to focus more on other areas of your business as well as boost sources of income with greater efficiency. You’ll also benefit from scaling up your operations quickly without needing additional personnel or increasing your budget significantly.

Time-saving

A virtual accounting assistant can free up time by taking over your financial obligations, such as Accounting. This leaves you more time to grow your business or optimize processes. Additionally, hiring a virtual assistant requires no learning curve as they already have experience managing accounts from various clients across many industries.

Increase productivity

With the proper Accounting VA, businesses can increase their productivity, improve business performance and pay only for the services they receive. This type of assistance is ideal for those who need to get through frequently tedious tasks quickly and with a high level of focus. By providing specialized services remotely, they also offer flexibility and convenience in managing large operations. Accounting virtual assistants can help make your team more focused and productive.

Access to talent, specialized skill sets

Hiring a virtual accounting assistant is ideal for businesses looking to quickly access specialized skill sets without additional staff. Having access to specialized talent is an essential ingredient for any successful business. Virtual accounting assistants have special skills that can help streamline financial operations.

Optimize tedious back-office operations

With the help of a virtual accounting assistant, businesses can optimize their operations and maximize efficiency by having someone dedicated to tackling tedious back-office tasks. A virtual accounting assistant can e-optimize your tedious back-office operations so that you can focus on what matters most to growing your business.

Managing a Virtual Accounting Assistant:

Managing a virtual accounting assistant can be easy with the right tools and guidance. With today’s technology, you don’t need a lot of tools to track your virtual assistant (VA) performance. You won’t need specialized experience or in-depth knowledge of accounting software programs or principles to manage a virtual assistant.

Conclusion:

Integrating an accounting virtual assistant into your business can significantly streamline and enhance your financial processes. By outsourcing routine accounting tasks to a virtual assistant, you can free up valuable time for yourself and your team to focus on strategic decision-making and core business operations. Additionally, a virtual assistant can provide accurate and timely financial reports and assist with invoice processing.

If you are looking to integrate a virtual assistant into your accounting business? Then schedule a free consultation with the Perfect Virtual Team today to drive your business toward success. Our team of highly-skilled professionals has the skills and experience to help you succeed in your accounting business.

VAs can bring accuracy, transparency, and profitability to your business model. With the right virtual team, you can become more organized and efficient. We’ll provide comprehensive support tailored specifically for your business needs so that you can focus on other essential things that help to increase your business profit.