Managing finances is essential to running any business, and virtual assistant QuickBooks has become the go-to accounting partner for small and medium-sized enterprises. Handling financial data can be time-consuming and overwhelming, especially if you are not an expert. This is where a QuickBooks Virtual Assistant comes into play. A QuickBooks Virtual Assistant takes care of all your financial tasks quickly and efficiently. In this article, we’ll explore why hiring a QuickBooks Virtual Assistant can help streamline your business operations while saving you time and money.

What is a Quickbooks Virtual Assistant?

A Quickbooks Virtual Assistant is a professional who specializes in providing financial management services. They possess various skills to stay on top of their client’s financial transactions, ensuring accuracy and timely reporting. Their primary responsibility is to ensure that their clients have access to up-to-date financial information, enabling them to make informed decisions about their businesses.

The virtual assistant will manage all the necessary tasks for bookkeeping, invoicing, payment remittance, and generating financial reports while keeping the business owner updated regularly. This allows busy entrepreneurs more time to focus on running and growing their businesses without worrying about managing finances or hiring additional staff.

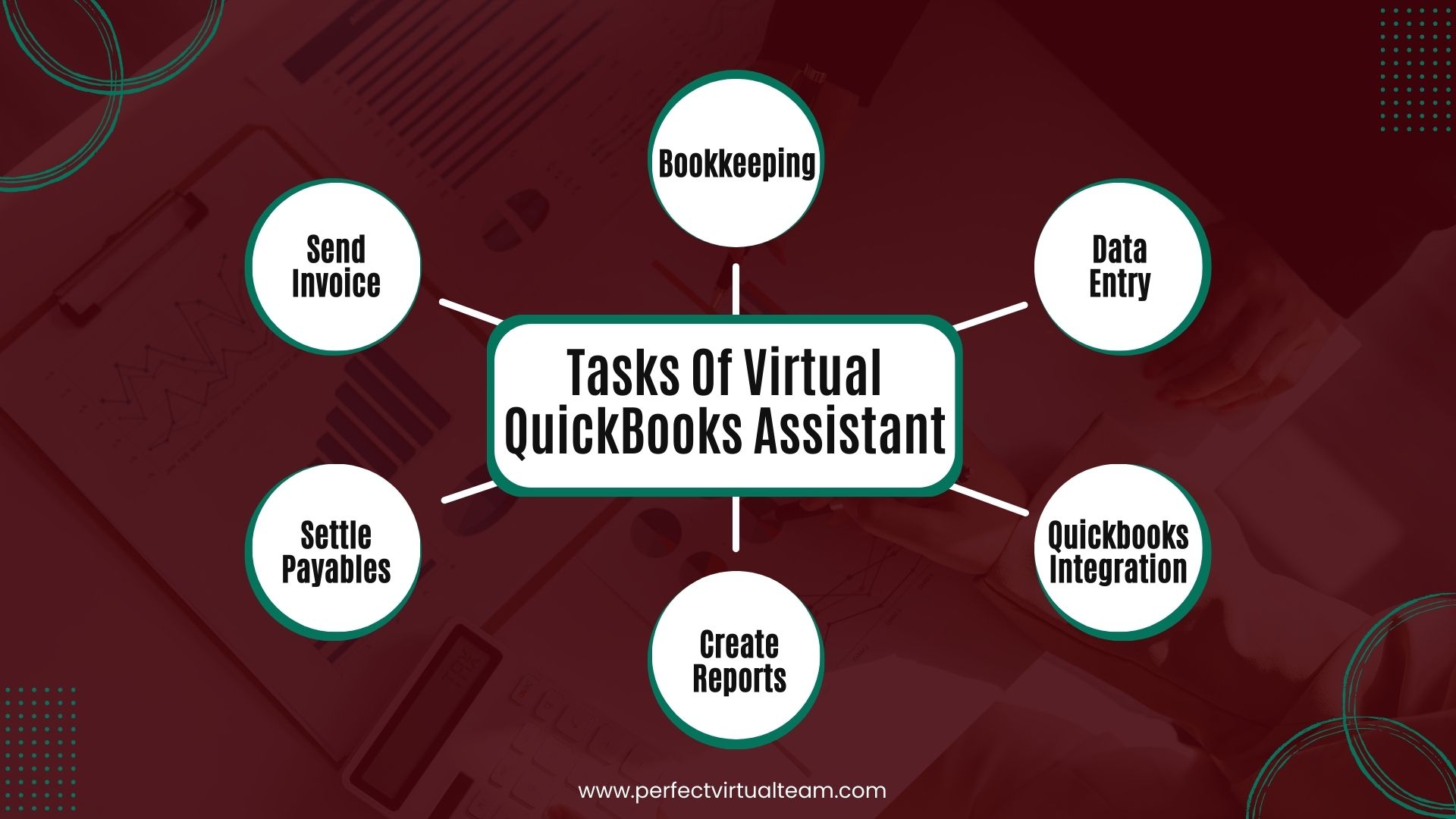

Tasks a Virtual Assistant QuickBooks can handle for your business

Quickbooks integration

One of the critical tasks a QuickBooks virtual assistant can do is to assist with integrating your old bookkeeping methods into QuickBooks. This involves migrating data from Microsoft Excel or other accounting solutions into QuickBooks, ensuring that the new system accurately captures and records all relevant financial information.

The integration process requires careful planning and execution to transfer data seamlessly without errors or omissions. A QuickBooks virtual assistant can help you identify which data needs to be migrated, create a plan for transferring it into QuickBooks, and execute the migration process.

Bookkeeping

QuickBooks virtual assistant professionals can help keep track of all financial transactions and ensure that everything is recorded accurately. They can also monitor sales and review payables to ensure the company stays within budget.

Streamline your financial management processes while reducing costs. Whether you need help with day-to-day tasks or complex accounting projects, these professionals have the skills and expertise to do the job right.

Data entry

Regarding data entry, a QuickBooks virtual assistant can be a lifesaver. A virtual assistant, QuickBooks, can help input relevant data into the system when the daybook format is manual. This task may seem mundane and straightforward, but it can be time-consuming, and the possibility of errors if done manually.

By outsourcing these responsibilities to a qualified QuickBooks virtual assistant professional, business owners can focus on other aspects of their operations while having peace of mind knowing that their finances are being managed effectively.

Send invoice

Sending invoices is an essential task that must be done efficiently and on time. Ensuring clients are billed on time is crucial to maintain a healthy cash flow for your finance business. Late or delayed invoicing can lead to unnecessary financial strain, which can negatively affect the growth of your business.

A QuickBooks virtual assistant can help you streamline the invoicing process and ensure the timely delivery of invoices to clients. They can also track payments and follow up with clients with outstanding balances, freeing up your time to focus on other aspects of your finance business.

They can generate detailed reports on invoice history, revenue trends, and customer behavior. This data can be used to make informed decisions about pricing strategies, marketing efforts, and resource allocation within your finance business. By hiring a QuickBooks virtual assistant, you will have access to accurate financial information that will aid in improving the overall performance of your finance business.

Settle payables

Virtual assistant QuickBooks can schedule payments for your business expenses. This involves setting up a payment system that promptly pays your vendors and employees. Doing this can avoid late fees and penalties, maintain good relationships with suppliers and staff, and keep your business finances in order.

When it comes to paying off payables, timing is crucial. QuickBooks virtual assistant services can help you manage the process by keeping track of due dates for bills, invoices, and other expenses. They can also set up automatic payments or reminders to ensure nothing will leave unchecked.

Create accounting reports

Our QuickBooks Virtual Assistants create accounting reports. This task involves organizing financial data and presenting it in an easily understandable format. With expertise in QuickBooks, our VA can generate accurate financial statements that provide a complete overview of the company’s finances.

Businesses can then make informed decisions and plan for growth based on a clear understanding of their financial status. QuickBooks Virtual Assistant’s ability to organize data effectively makes it easier for stakeholders to understand their business finances and identify areas where improvements could be made.

Benefits of Hiring a QuickBooks Virtual Assistant

Save time

Hiring a virtual assistant QuickBooks to manage your tasks, such as accounts payable and receivable and bank reconciliations, can free up valuable time and energy that you can use to focus on growing your business.

Outsourcing back-end work to a virtual assistant can also improve the accuracy and efficiency of your accounting processes. Virtual assistants specializing in QuickBooks are experts in navigating the software and keeping all financial data organized to save time for processing & decision-making.

Increase productivity

QuickBooks virtual assistant can focus on value-adding tasks. This means you can delegate them time-consuming and routine financial tasks, which frees up your time to work on more critical business activities like revenue-generating projects, product development, or sales. A VA with expertise in QuickBooks can help you manage your finances efficiently and accurately.

Having a QuickBooks virtual assistant on your team also means worrying less about whether or not your finance books are up-to-date and accurate. They will ensure that all financial transactions are recorded correctly, regularly reconciled, and all necessary reports are generated on time. Moreover, having a dedicated person handling these tasks reduces the chances of errors and missing out on some things in bookkeeping.

Be in a better financial position

For many small business owners, keeping track of finances can be daunting. However, with the help of a virtual assistant who specializes in QuickBooks, business owners can ensure that their accounts are well-organized and up-to-date. A QuickBooks virtual assistant has the necessary skills and expertise to manage financial data efficiently and accurately.

Business owners & managers can access expert advice on financial matters such as taxes and budgeting. Virtual assistant QuickBooks will provide regular reports on your company’s financial performance so you can make informed decisions about future investments and financial strategies.

Help prevent burnout

One of the biggest challenges that business owners face is burnout. It’s easy to get caught up in day-to-day tasks and forget about caring for yourself. However, this can lead to stress, fatigue, and ultimately burnout.

A virtual assistant can handle many administrative tasks like bookkeeping, invoicing, and data entry. This frees up your time so you can focus on growing your business or simply taking a well-deserved break and reducing stress levels associated with managing finances and paperwork.

Customer satisfaction

When it comes to customer satisfaction, answering billing questions promptly is crucial. Customers who doubt their bills can quickly become frustrated, leading to negative reviews and churn. A QuickBooks virtual assistant can help businesses stay on top of their accounts receivable by sending payment reminders and addressing client inquiries promptly. By hiring a QuickBooks virtual assistant to handle billing questions and phone calls, businesses can ensure that customers or clients are satisfied with the services and willing to recommend them to others.

Conclusion

QuickBooks Virtual Assistants can make a significant difference in the growth and success of your finance business. With their expertise in QuickBooks, they can manage your bookkeeping, invoicing, and other financial tasks efficiently and accurately. This will free up valuable time to focus on more critical aspects of your business. By hiring a QuickBooks Virtual Assistant, you can save money on overhead costs while benefiting from their professional service. So don’t wait – Schedule a free consultation with the Perfect virtual team today to hire a highly experienced and trained QuickBooks Virtual Assistant.

Our QuickBooks Virtual Assistants have the necessary skills and expertise to handle all your bookkeeping and accounting needs. They optimize your time-consuming tasks to free up your time to grow your business. We help you to build a high-performance team that delivers results. Our QuickBooks VAs assist you during your time zone. They work according to your schedule and ensure timely completion of all tasks.